The Purchase of Long-term Assets by Issuing Debt

By issuing debt eg corporate bonds companies are able to raise capital from investors. Acquisitions of other businesses or companies.

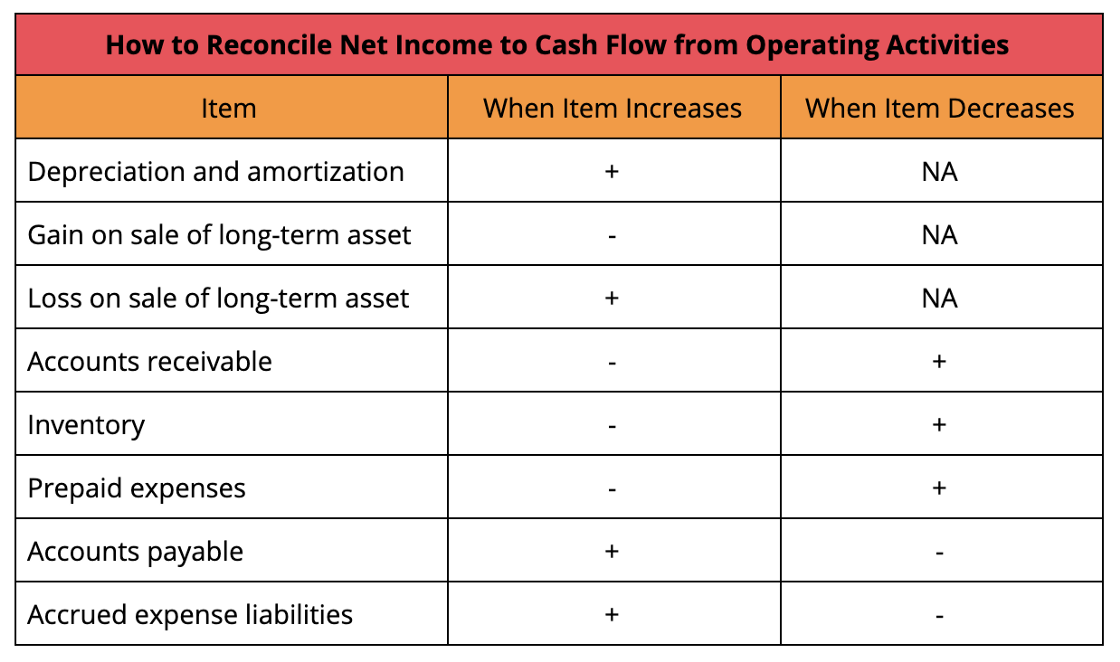

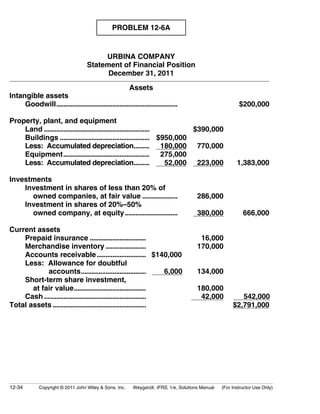

How To Prepare And Interpret A Cash Flow Statement

Issue equity and use the proceeds to purchase inventory.

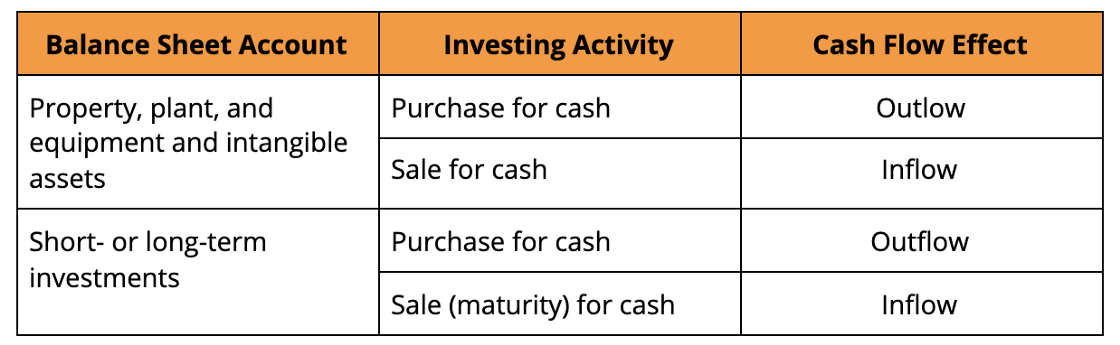

. Purchase of long-term assets Purchase of investments except trading securities Loaning cash to others Obtaining the data for the investing activities section involves three steps. The effect of this transaction is to reduce long-term assets by 100000. It usually involves sale and purchase of long term investments in debt and equity instruments of other companies.

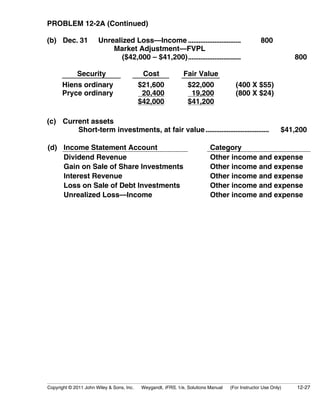

Cash paid for purchase of new long term assets. Credit cards and student loans are also referred to as securitized debt and although they are not backed up by a certain asset the bank is allowed to go after the owners personal asset in the case of a default on a loan. H Sold long-term investments in marketable securities with a 50000 carrying value at a loss of 17500.

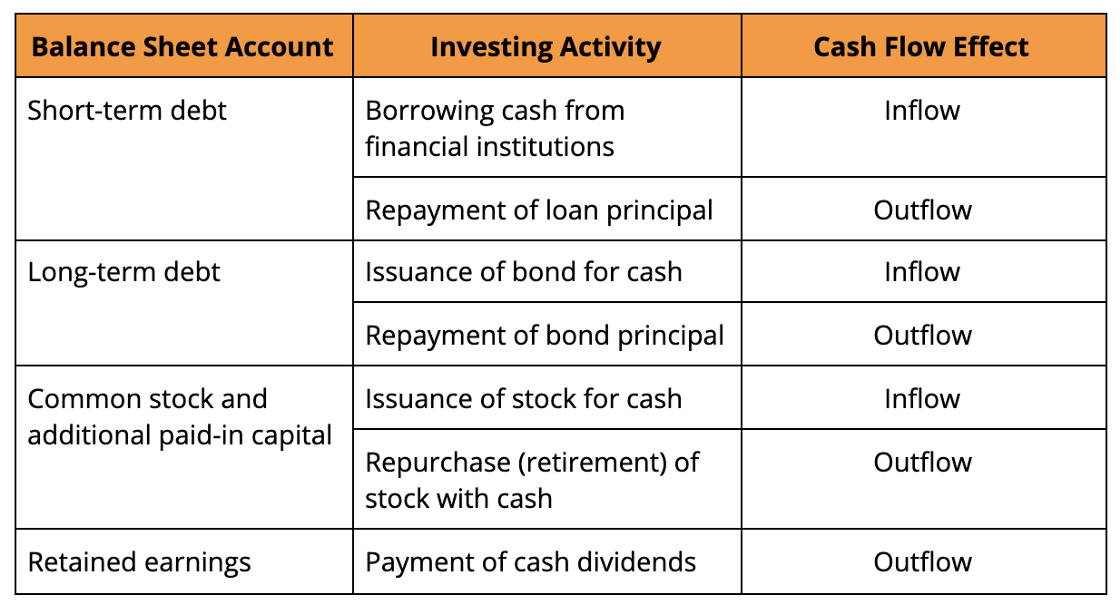

The purchase of inventory for cash is classified in the statement of cash flows as an. Exchange of noncash assets for other noncash assets. Cash flows from Financing activities.

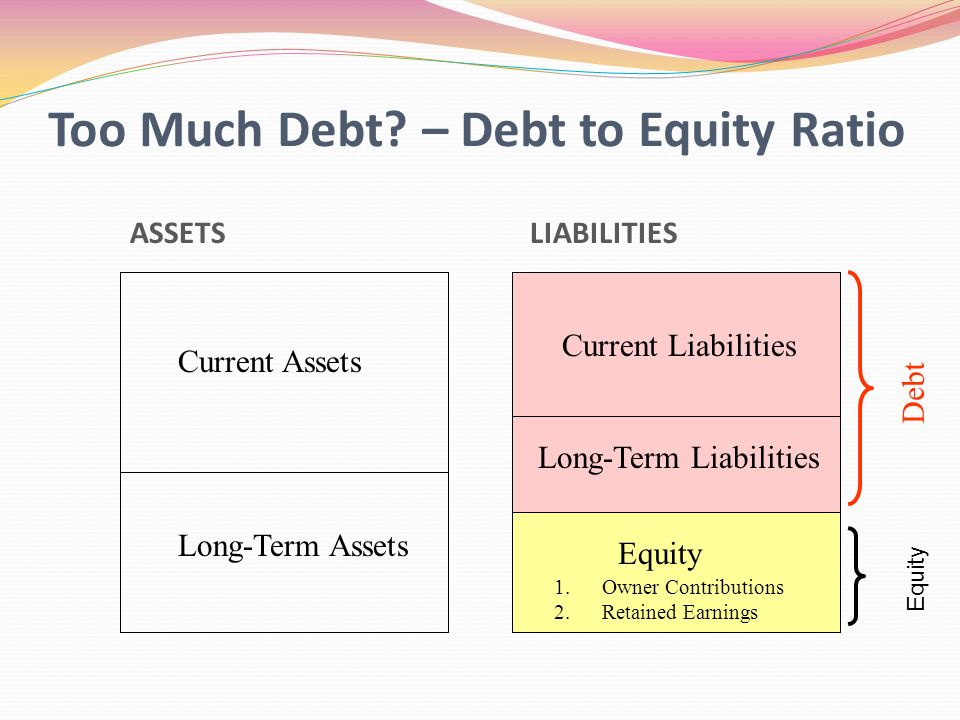

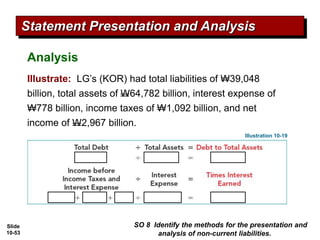

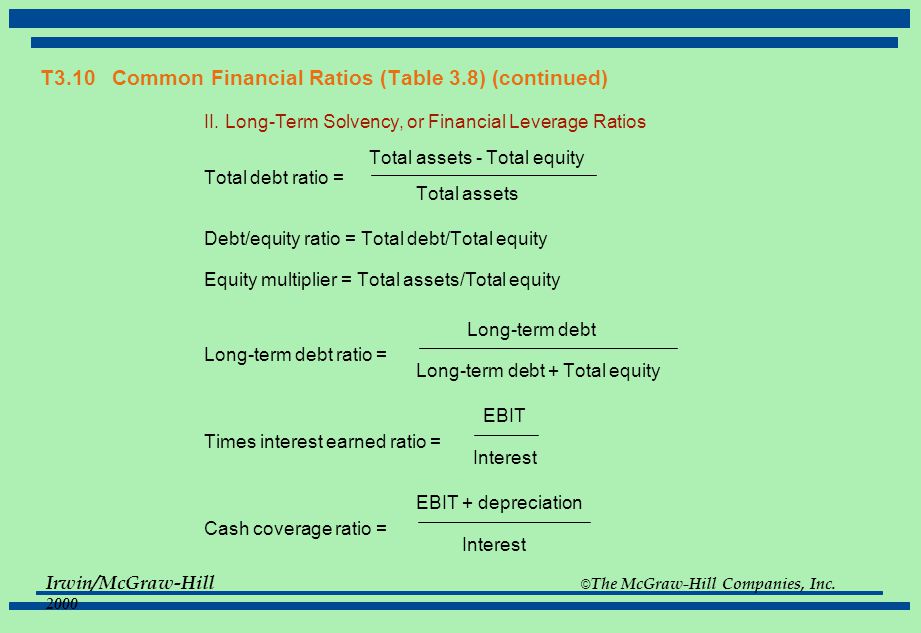

Net cash provided used by Investing Activities. Using debt the company becomes a borrower and the bondholders of the issue are the creditors lenders. Which of the following ratios would be increased by this transaction.

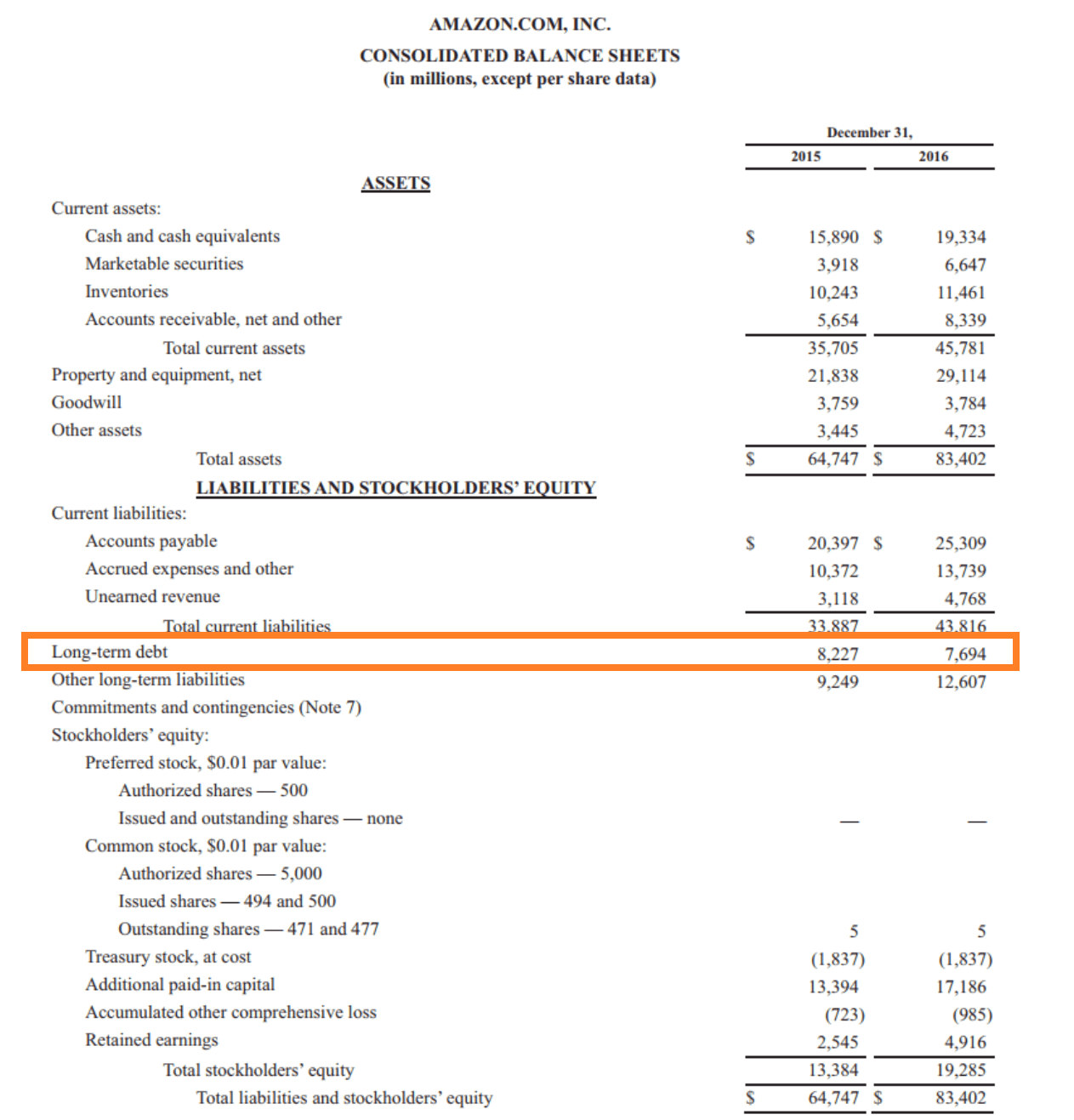

Purchase of long-term assets by issuing a note or bond. On December 31 1991 Northpark Co. Businesses seek long-term debt financing to purchase assets such as buildings equipment and machinery.

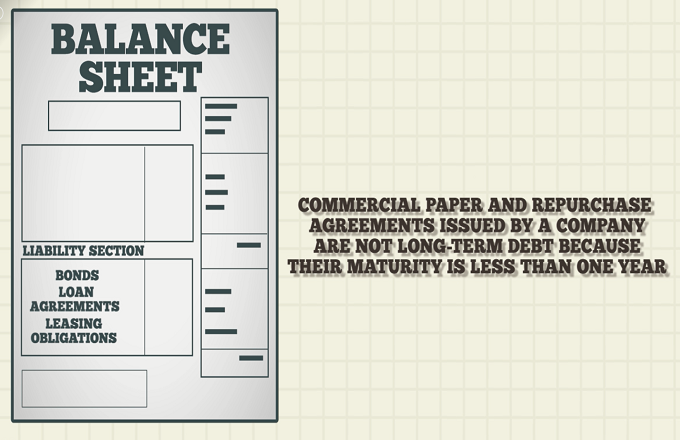

A positive amount signifies an improvement in the bonds payable and indicates that cash has been generated by the additional bonds issued. Issue short-term debt and use the proceeds to purchase inventory. Examples of debt instruments also known as debt securities are government bonds corporate bonds and mortgages.

All of these are noncash transactions. It is generally used to purchase long-term assets or help fund day-to-day operational costs. Issue long-term debt and use the proceeds to purchase fixed assets.

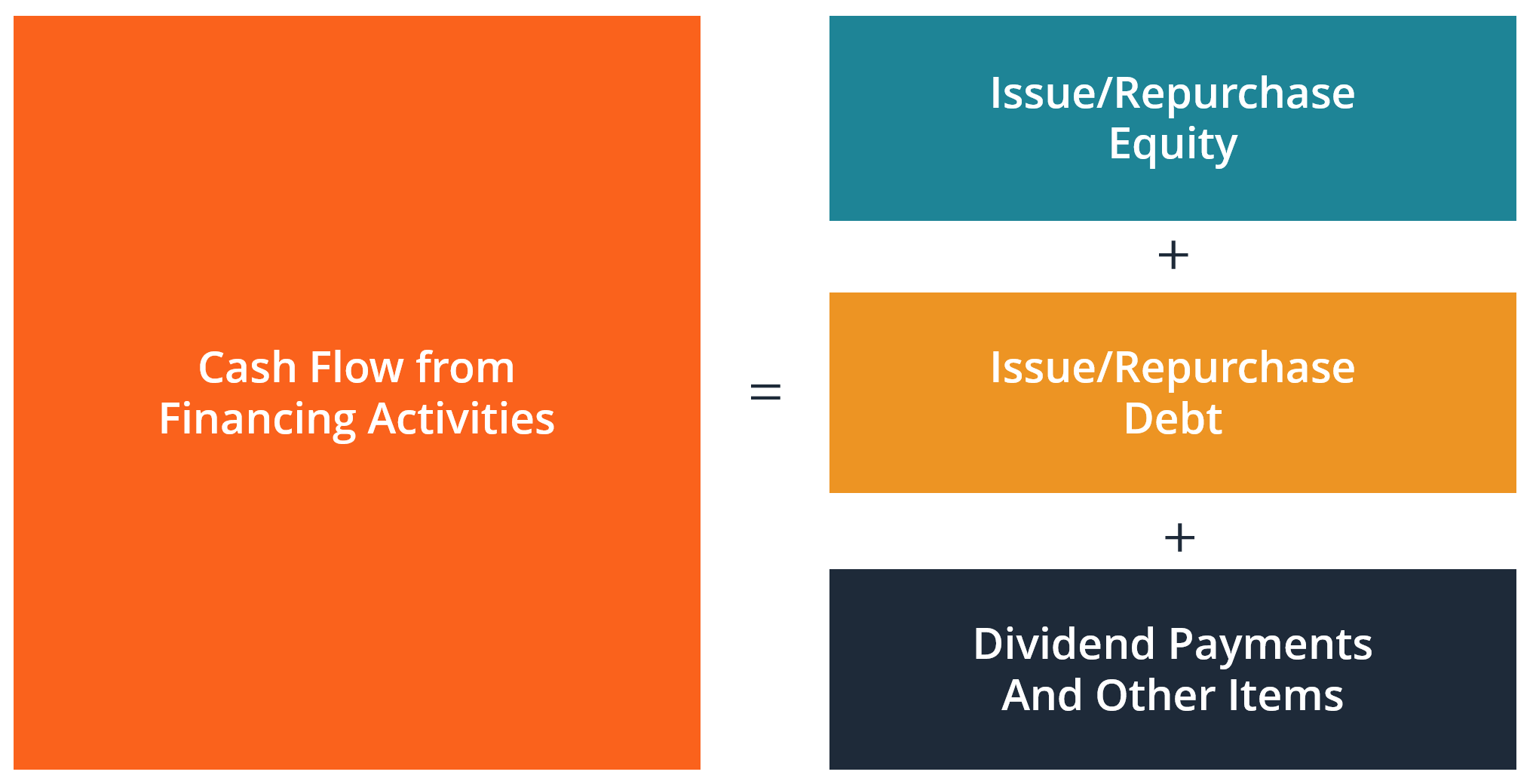

Calculate the increase or decrease in the long-term asset. Cash received from long term liabilities cash paid on long term liabilities cash received from issuing stock cash paid for dividends cash paid to purchase treasury stock. Issuing debt or equity securities o Issuing bonds o Issuing Stocks Common and Preferred.

The purchase of long-term assets by issuing debt is recorded as both an investing activity and a financing activity. The largest line items in the cash flow from the financing section are dividends paid repurchase of common stock and proceeds from the issuance of debt. Or bank loans to businesses.

A company that needs money for its business operations can raise capital through either issuing equity or taking on long-term debt. Conversion of preferred stock to common stock. Purchase of noncash assets by issuing equity or debt.

Lease of assets in a capital lease transaction. Dividends paid and repurchase of common. The holder of such instruments is entitled to receive a periodic interest income.

An example of financing activities involving long-term liabilities noncurrent liabilities is the issuance or redemption of debt such as bonds. Retirement of debt by issuing equity stock. Debt Financing Over the Long-Term.

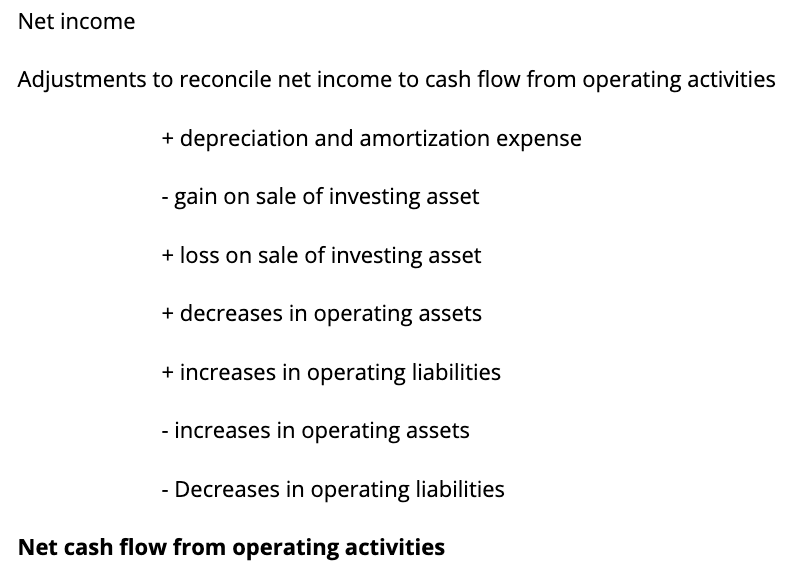

Purchase of property plant and equipment PP. The total net cash flows from operating activities are identical under both the indirect and direct methods. -Purchase of long-term assets by issuing debt-Purchase of long-term assets by issuing stock-Conversion of bonds payable into common stock-All of these are noncash transactions.

For an issuer long-term debt is a liability that must be repaid while owners of debt eg bonds account for them as assets. False The total net cash flows from operating activities differ between the direct and indirect methods. Wrote a check for 648000 for the purchase of machinery.

The purchase of long-term assets by issuing debt is recorded as both an investing activity and a financing activity. Collected a receivable due from a major customer. Whether it chooses debt or equity depends on the relative cost of.

The assets that will be purchased are usually also used to secure the loan as collateral. Purchase of long-term assets by issuing debt is an example of a noncash activity Look for a transaction that does not increase or decrease cash. Long-term debt liabilities are a key component of business solvency.

Proceeds from the sale of PP. The scheduled repayment for the loans is usually up to 10 years with fixed interest rates and predictable monthly.

C H A P T E R 14 Non Current Liabilities Intermediate Accounting Ifrs Edition Kieso Weygandt And Warfield Ppt Download

Cash Flow Statement Cfs Structure And Format Excel Template

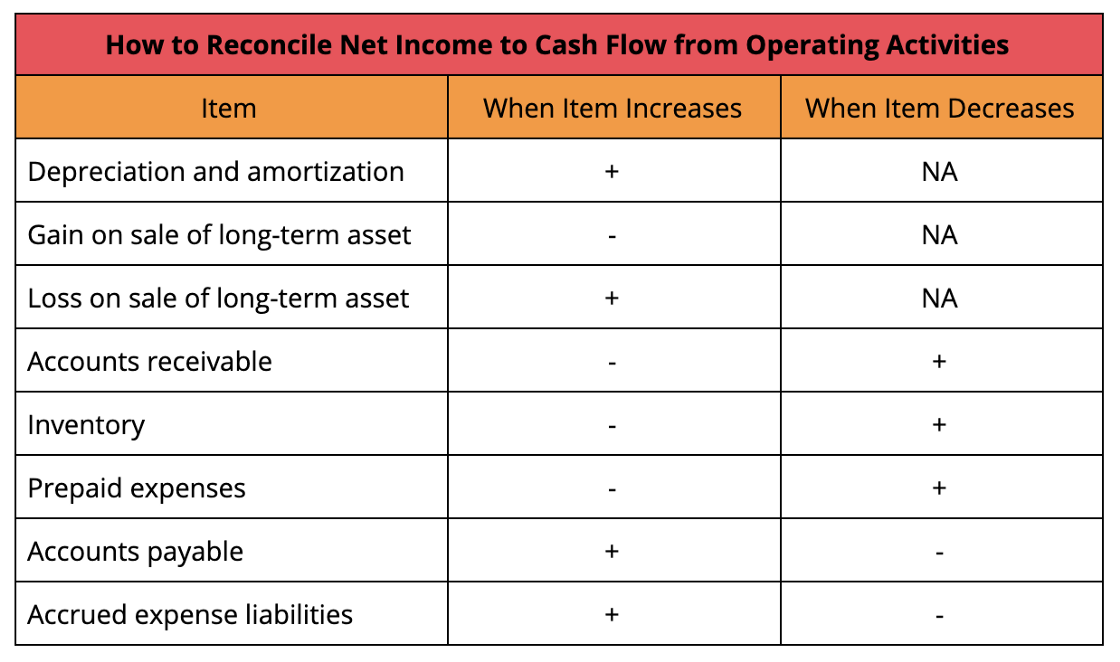

Ch12 Solution W Kieso Ifrs 1st Edi

How To Calculate The Debt Ratio Using The Equity Multiplier The Motley Fool

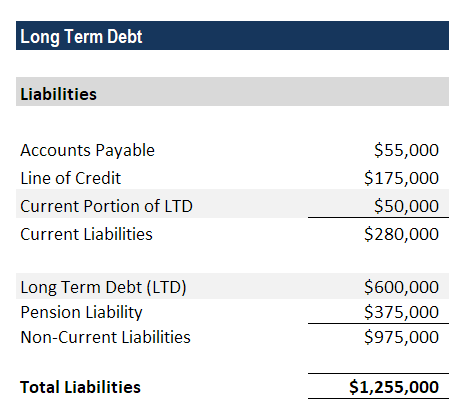

Long Term Debt Definition Guide How To Model Ltd

Accounting And Financial Decisions Ppt Download

Ch12 Solution W Kieso Ifrs 1st Edi

:max_bytes(150000):strip_icc()/dotdash_INV_final_Capitalization_Ratios_Jan_2021-01-39b098a2a4f645ddb752bbd1887a488c.jpg)

Capitalization Ratios Definition

Long Term Debt Definition Guide How To Model Ltd

How To Prepare And Interpret A Cash Flow Statement

Slide 3 1 Slide 3 2 Consolidated Financial Statements Date Of Acquisition Advanced Accounting Fourth Edition Ppt Download

Pengantar Akuntansi 2 Ch10 Liability

How To Prepare And Interpret A Cash Flow Statement

Cash Flow From Financing Activities Overview Examples What S Included

Comments

Post a Comment